This post presents 1) the point of view of tech journalists that regularly read survey-based reports and 2) survey data interesting to IT vendors that sponsor these surveys.

Tech Journalists

I conduct at least four surveys a year and write a weekly column about other people’s surveys. Obviously I am interested in technology journalist Adrían Bridgwater’s “How To Read Technology Surveys“. He starts by acknowledging that even independent research skews towards the core interests of the sponsor. Here are a few key takeaways:

- Even independent research skews towards the core interests of the sponsor. “There is clearly a certain gravitational pull to keep surveys close to an organization’s market interests.”

- IT surveys typically analyze a specific segment or platform issue. With their narrow focus, vendors usually present contrived analysis even when they do not create ‘loaded’ questions that “produce a self-serving result.”

- What not to look for: if the conclusion recommends you should by type of services it provides, that is a red flag. For example, “if a leading brand of data storage conducts a survey into data storage vulnerabilities, then you can reach for a good pinch of salt.”

- Yawn: findings are often “blindingly obvious” and therefore not newsworthy.

- The most useful data insights are found by drilling down into the survey content, but often support a conclusion that is not directly related to the message the sponsor wants to communicate.

Also worth reading is Kevin Townsend’s “Can You Trust Security Vendor Surveys?” Like Adrían, he believes journalists are responsible for filtering hyperbole and the most unreliable or biased survey-based PR-pushes. Here are a few key takeaways:

- Surveys are “an analysis of people-provided information, not data-provided facts.”

- Sample size matters because it affects the margin of error.

- “Any survey delivered without a demographic breakdown of the respondents should be considered suspect.”

- Survey design is an art. Vendor-written questions are often leading or ambiguous.

IT Vendors

- Mantis Research and BuzzSumo’s “State of Original Research for Marketing in 2019“: 39% of the 644 content marketers surveyed said their organization created and published original content in the past 12 months. The following findings are based on:

- WHAT

- Not all original research is based on surveys. Analysis of third-party data sources, analysis of proprietary data and one-0n-one interviews are also published.

- 66% publish a methodology. Of this group, 70% include the dates of survey collection and 24% attempt to describe possible biases in the respondents.

- HOW

- Most (85%) produce blog posts on their own website based on the research. Industry presentations (34%) and webinars (31%) are areas that may deserve more attention.

- 65% at least sometimes “gate” their survey-based research findings, which makes sense because 55% are using the content to generate leads.

- From strategy to final publication, 65% say that survey-based research takes more than 2 months. I agree with Mantis Research’s suggestion to budget at least 3 months, with the middle month dedicated to data collection.

- PERCEPTIONS

- 94% believe original research elevates their brand’s authority and 92% believe the survey-based research they publish is based on credible data.

- 75% believe their team knows how to write survey questions that will generate interesting story ideas.

- WHAT

- IDG’s “2019 Customer Engagement Study“: 79% of ITDMs (IT decision makers) are willing to register for content if they know they will receive value in return. However, only 38% of downloaded work-related content has provided value in the past 12 months.

- Content Marketing Institute’s “Technology Content Marketing 2019: Benchmarks, Budgets, and Trends“: I’m waiting for the 2020 version of the report before I type up some key takeaways.

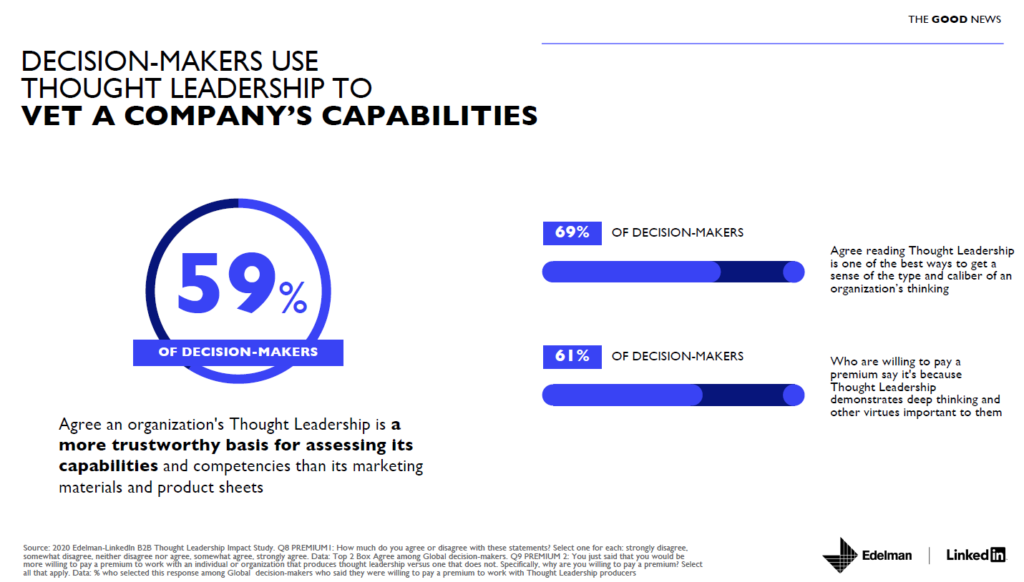

- Edelman’s “2020 Edelman-LinkedIn B2B Thought Leadership Impact Study“:

- Low quality content is a risk to reputation and sales. 27% of decision makers said that reading thought leadership has at least sometimes directly led to them not awarding business to an organization. 38% said that their respect and admiration for a company has decreased after reading thought leadership from them.

- 42% of executives say they would be more willing to pay a premium to work with an organization that produces “thought leadership” as compared to those that do not.

- I previously wrote about this topic in 2015.

3 Charts From Research Cited Above

Featured image is a photo by Gregg Tavares of statues in the Louvre depicting omphaloskepsis (navel-gazing).