Even in a decentralized world geography matters. In the crypto space, many countries are over-represented as compared to the larger economy. Although the United States continues to lead by several metrics, the countries of the former Eastern Bloc have begun to rival what was once called the “West”.

But how is location determined in cyberspace? The answer has significant implications on taxes paid and the regulations that apply to online activities. The place where the economic activity occurs is often where the taxes are applied. In addition, having a substantial physical presence makes more laws and regulations apply to a company. To further complicate things, the official location of multi-national companies is often reported as being where the corporation is officially registered as a legal entity.

There are two other ways to determine a project’s geography. One is the the location of the actual physical infrastructure where code is running. In other words, where the servers are. Even “serverless” applications rely on distributed physical compute and network resources running in a cloud provider’s data center or a cluster of devices. The other way to look at location is based on where the individuals running a project are located.

Each method produces different results but across the board, Strategic Coin found that Russia and several smaller countries play an outsized role for cryptocurrency and the larger “decentralized” movement.

Where is Bitcoin Accepted?

As reported last week, 63,782 websites worldwide accept bitcoin. According to SimilarTech analysis of where servers are located, 22.9% of bitcoin-accepting sites are based in the United States, 5.1% are based in Russia, followed by the United Kingdom (4.1%), Brazil (3.7%) and Germany (3.5%). Government restrictions on bitcoin may have taken China out of the leaders list. Sites like Coin Dance track the legality of bitcoin in different countries.

Since we are still flesh and blood, it is also important to track brick and mortar establishments that accept bitcoin payments. Satoshi Labs has created Coinmap.org, which tracks the location of physical stores that let you pay with bitcoin. So far, it has over 12,000 in its database, but it does not appear to be have been kept up to date.

Where Are Decentralized Projects?

Determining the geographic location of a crypto project is not easy. True decentralized projects do not have a physical location. Many project participants hide where they are located. Other projects have contributors throughout the world. Despite difficulties, there have been many different attempts to determine the location of ICOs, which can be more accurately described as a token generation events. The most common methodology is based on the country where the project’s legal entity is registered, but looking at where team members are located also provides insight.

ICORating’s ICO Market Research Q1 2018 employs both of the approaches described above. According to the report, 402 ICOs were staged in first quarter of 2018, with 204 raising more than $100k. The specifics of how many ICOs occurred and how much they raised differs based on the methodology used. For example, ICOBox determined there were 285 completed ICOs in Q1 2018, while CoinDesk based on what appears to be a less complete data set. The inclusion of incomplete token generation events in ICORating’s statistics means that projects that are likely to never succeed are counted alongside completed, “successful” token launches.

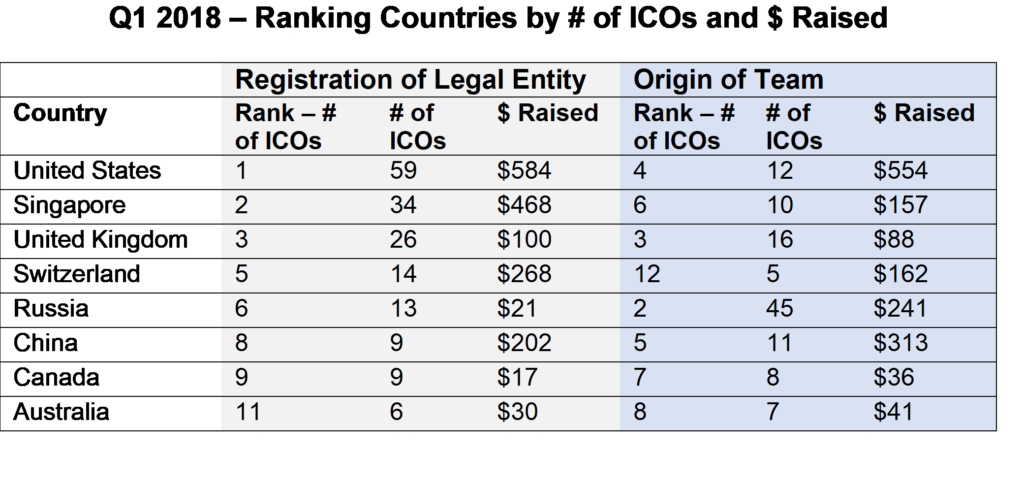

Three quarters of projects in the ICORating database have a legal entity. The Unites States is by far the leader with 59 projects staged in Q1 2018. Singapore comes in second with 34. The United Kingdom (26), Estonia (16) and Switzerland (14) round out the top five.

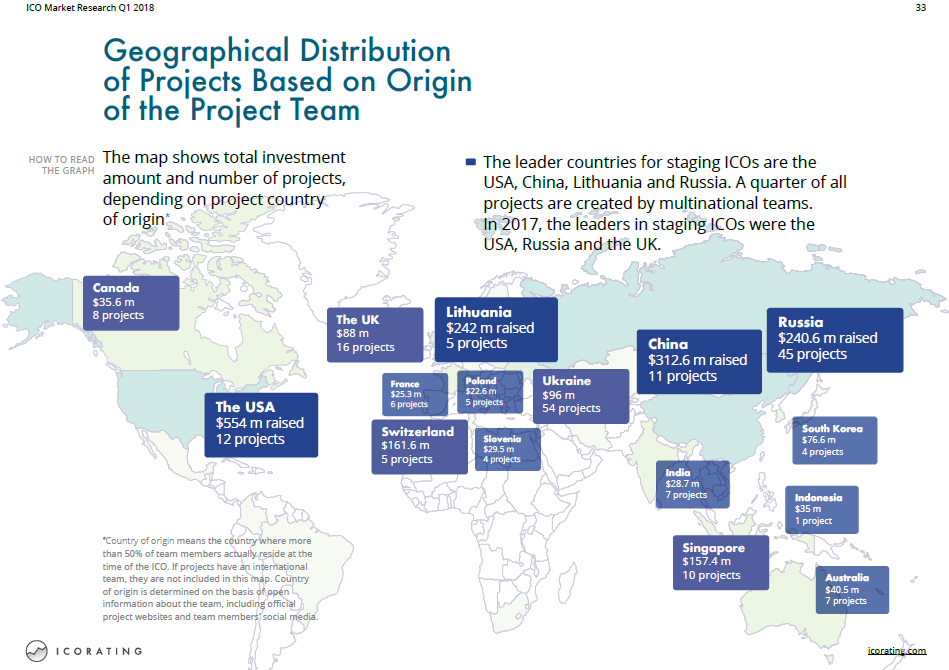

The results are significantly different when looking at where team members actually live. Using the same data set, a quarter of projects are truly “international”, but the rest have a majority of team members residing in one country. The leader is Ukraine with 54 ICOs staged in Q1 2018. Russia comes in second with 45. The United Kingdom (16), United States (12) and China (11) round out the top five.

We looked at other data sources to confirm the findings described above.

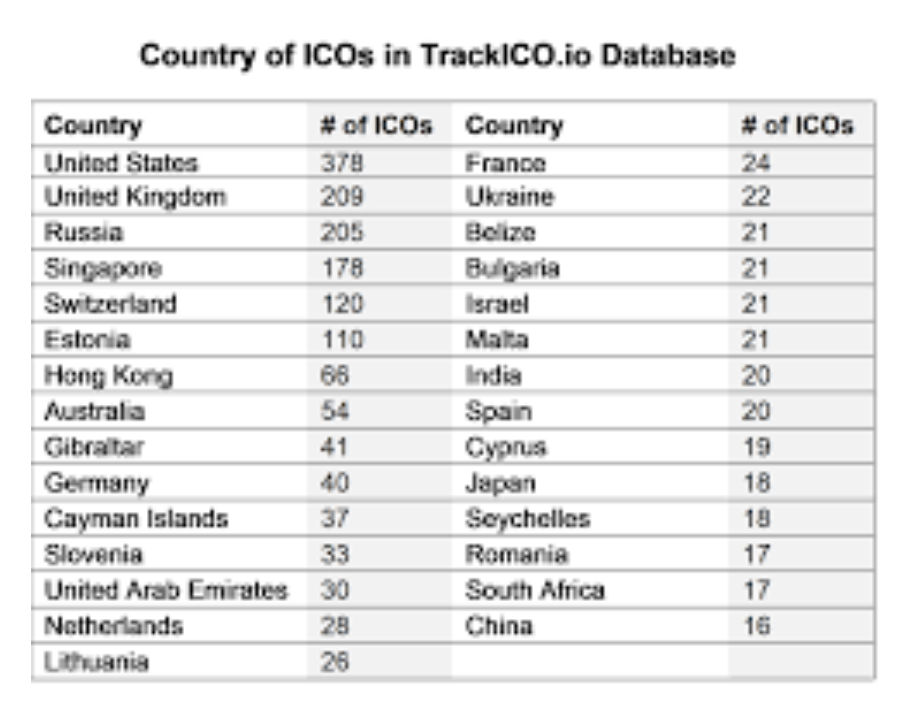

TrackICO.io tracks geography based on where a project is registered. The table below represents 67% of the 2,731 token generation events in its database. Taken together, the former Soviet Union’s SSRs in the table (Russia, Estonia, Lithuania, Ukraine) host more ICOs than the United States. Beyond the top five, Gibraltar, Cayman Islands, Belize, Malta and Seychelles are notable for their friendly tax and regulatory environments.

Finally, although we did not investigate where tokens’ web servers are based, we did look at the technology stack they deploy. In November 2017, Strategic Coin used Clearbit to investigate the technologies used by a sample of about 100 ICO’s websites. Looking at the cloud service providers being utilized, the global leaders Amazon Web Services, Microsoft Azure and Google Cloud Compute Platform led the list. However, Russian Yandex was fourth and ahead of companies like Digital Ocean and Heroku.

Conclusion

For many, talking decentralization and geographic location should not be mentioned in the same sentence. In the truest sense of the term, a decentralized project has no location and therefore cannot be based in any specific country. Yet, in the real world location matters because people still live somewhere and governments still have jurisdiction, at least when a cryptocurrency is converted into fiat. The greatest number of ICOs being staged are coming from teams based in the Ukraine and Russia. Yet, a majority of these projects are not legally registered in those countries and many may never actually be completed. Instead, the United States, United Kingdom, Singapore as well as a few regulatory friendly countries are where completed projects are most likely to be domiciling.

The feature image is highlights the location of crypto mining with data collected from Shodan.io.

Originally published on Strategic Coin, a website that is no longer operational.