Biased analysts abounded in the 90’s. Today, an overflowing room of analysts gathered at the first Investorside Conference to defend their profession. The main themes were the growth of the independent research industry and ways to eliminate incentives for research to be influenced by covered companies, investment bankers, and other interests. Here are some of the most important pieces of information I collected from the conference:

- Stanton Green, president of Vista Research, said that his firm has a 90% customer renewal rate and that their customers are split 60/40 between mutual and hedge funds.

- Peter Sidoti of Sidoti & Company claimed that after all costs are considered, it costs $300K to cover a company at bulge bracket firm like Goldman Sachs. Sidoti specializes in analyzing in small-cap stocks and says that hedge funds don’t trade in these companies.

- BNY Jaywalk’s Christian Ward discussed his company’s business, which was established to help large financial institutions fulfill their obligations under the Spitzer Settlement to purchase independent research. BNY Jaywalk helps investors set up evaluation tools to review what research to buy. It allows researchers to sell their research on a per copy basis; clients are only allowed to view reports of companies that are rated the best. Debra Walton, Global Managing Director of Research at Thomson Financial, said that Thomson has created an independent research dashboard to demonstrate value and let users fulfill their fiduciary obligations to diligently measure the performance of the analysis. Stephen Parker, founder of Rontech talked about his company’s software, which allows mutual funds evaluate research, brokers and vendors and comply with laws and regulations.

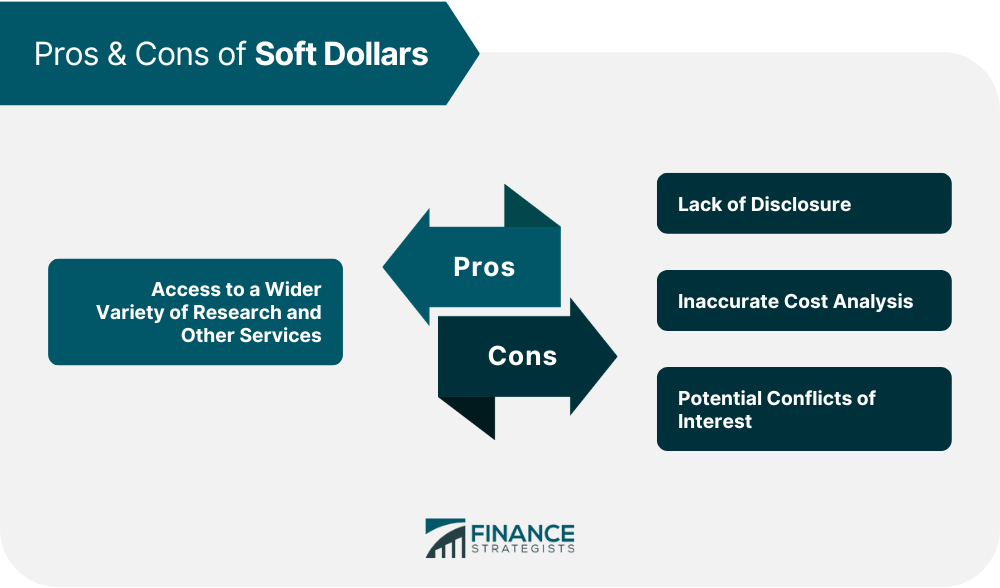

- The panel on soft dollars attempted to disprove certain myths about soft dollars. The panelists claimed that most abuses had taken place at investment banks and not in their segment of the industry. In fact, they provided several credible arguments about why eliminating soft dollar payments would only help the large institutions that were responsible for the abuses of the ’90s. They emphasized that best execution of trades meant getting the best total return and not just lowered trading costs. Also, they claimed that transparency and disclosure in trading was incredibly important. From this perspective, mutual funds are already highly regulated, while hedge funds have almost controls on them.