Key Takeaways

- Institutional funding for blockchain innovation is being funneled into incubators and accelerators due to legal concerns about ICOs.

- The purpose of incubators and accelerators is to support entrepreneurs as they turn their ideas and make them into real businesses. They are an obvious way to raise money for an idea whether or not a token generation even is mentioned in a white paper.

Blockchain technology has catalyzed change across a broad spectrum of industries and markets but its been impact has been particularly noticeable in the startup environment. Billions of dollars are being directed towards promising new concepts and platforms, with much of that coming through token generation events. In 2017 initial coin offerings (ICOs) became seen as a preferable alternative for capital generation by blockchain startups, allowing them to avoid the barriers to entry associated with traditional venture capitalists (VCs).

Strategic Coin has previously examined the rise of decentralized funding and crowdfunding alternatives in the blockchain space. These efforts, along with ICO-generation platforms, are promoted as democratizing investment opportunities. Yet, they are often very similar to more traditional incubator or accelerator efforts. No matter the name, we expect to see early stage investments being funneled through organizations that help individuals reduce their risk and evaluate opportunities in decentralized technologies.

ICOs Make Up for Europe’s Traditionally Weak Venture Capital Formation

Private investment funds are now both investing in and building new blockchain technology, with Europe leading the way. According to analysis by venture capital firm Atomico in late 2017, in the prior three years there were 446 token offerings based in the European Union, while only 244 came from North America. The European ICOs raised $1.76 bln, with the North American ones generating $1.08 bln. While many Silicon Valley VCs are actively funding blockchain and crypto projects, this represents a real opportunity for Europe to catch up from what has historically been a competitive disadvantage. Furthermore, a study published last year indicated that European investment advisors had had less barriers to making investments in blockchain infrastructure.

Not only are funds investing in startups, but they are also looking internally. Recently, five of the largest UK fund houses — who collectively manage more than $1 trillion in assets — have joined together in a project designed to test the capacity of blockchain technology in eliminating financial intermediaries. In the US, platforms such as Northern Trust are implementing blockchain technology to optimize private equity administration. The innovation benefits offered by blockchain tech for both private investment funds and their clients has made DLT platforms and, by extension, initial coin offerings, a prime target for fast-moving venture capital, driving private investments funds towards the blockchain both in the US and abroad.

Investors are attracted to the capital the market has raised. A CB Insights report indicated that blockchain startups received by times as much capital via ICOs compared to traditional VC funding. Furthermore, according to a Q1 2018 report published by Fabric Ventures and TokenData, ICOs generated over $5.6 bln over the course of 2017. Of the 913 token sales identified by that study, 48% met their funding targets. While, pundits caution about a high failure rate, VCs are used to risky investments

Although ICOs were the de facto capital generation mechanism for blockchain startups in 2017, that may not continue to be the case. The main reason institutional investors have avoided ICOs is their uncertain regulatory and legal status. Now, with more scrutiny on SAFT agreements, it appears there will be even less ability for accredited investors to fund pre-ICO ideas.

Firms like Andreessen Horowitz and Union Square Ventures will continue to make bit bets through traditional equity stakes. Crowdfunding and ICOs will continue to attract money, especially outside the US. But in addition, early stage investors are looking at incubators and accelerators as alternatives.

Early Stage Investing Without Crowdfunding or ICOs

Blockchain incubators and accelerators have become fertile ground for early stage ideas and ventures that lack the capacity or desire to launch a successful initial coin offering. Indeed, many of the ICOs that failed over 2018 would have been accepted into incubator and accelerator programs, which have traditionally been the home for riskier projects.

Incubators and accelerators present legacy VCs with the opportunity to invest in promising blockchain platforms, concepts, pre-ICO business formations, and ideas without directly exposing themselves to the regulatory risks associated with the token generation events. By investing directly into promising blockchain business before the ICO stage, VCs are able to circumvent the legal issues presented by initial coin offerings and minimize their risk profile.

Until slow-moving regulatory frameworks adapt to the shifting blockchain ecosystem, accelerator programs and incubators are likely to remain the most viable method via which traditional VCs are able to enter the blockchain marketplace of ideas. Thus, specialized blockchain accelerators are highly attractive to VCs and institutional investors for the following reasons:

- Blockchain is a fast moving environment that has generated significant returns.

- Institutional investors and legacy VCs want to allocate capital into blockchain projects, but are precluded from participating in ICOs due to regulatory restrictions.

- Incubators and, to some extent, accelerators, are a focal point for early-stage ideas and business plans — which are abundant in the blockchain ecosystem.

As such, incubators and accelerator programs that focus on the blockchain environment are beginning to emerge as a bridge between the legacy VC hierarchy and the rapidly-evolving initial coin offering ecosystem. How do these platforms differ from traditional incubators and accelerators, however, and what do they really do for developing businesses?

What’s the Difference Between a Blockchain Incubator and Accelerator?

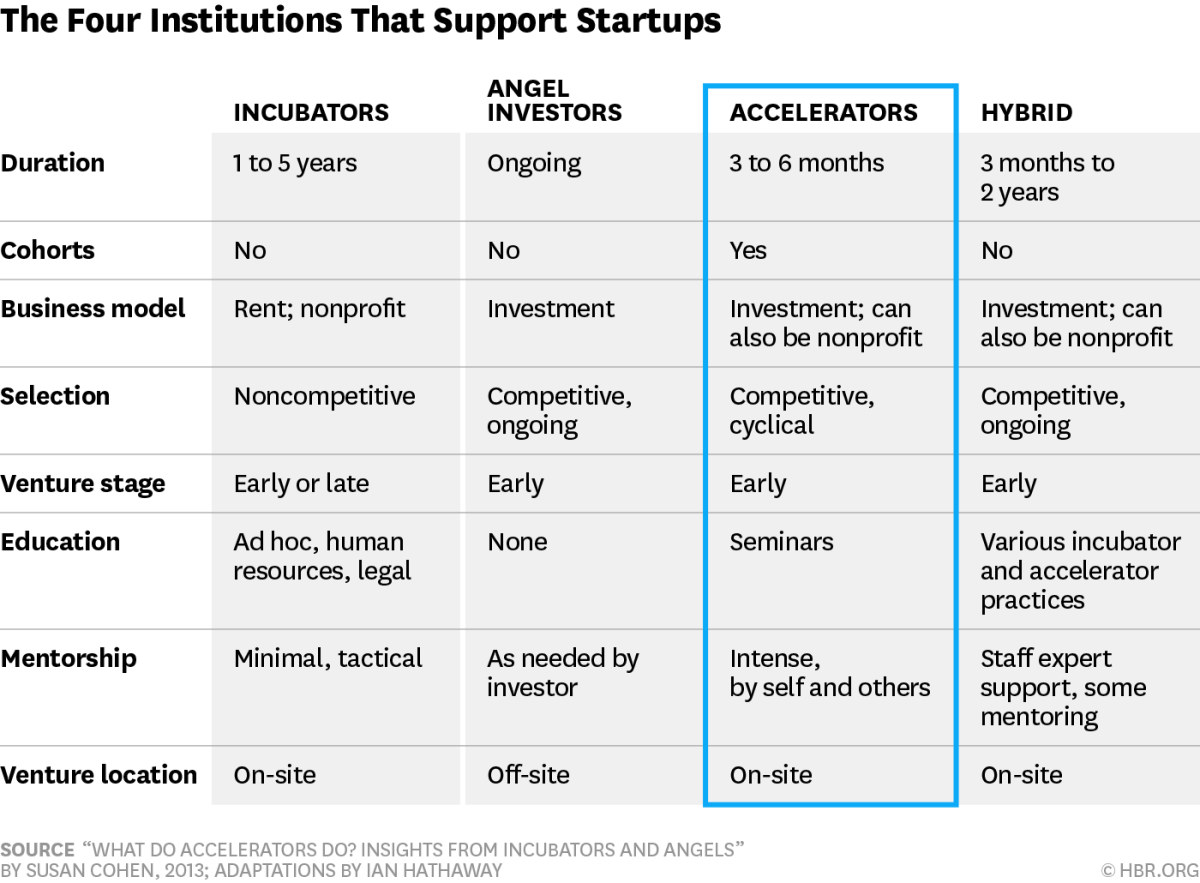

Both incubators and accelerator programs perform similar functions in the startup ecosystem, but are often conflated. The fundamental purpose of both platforms are identical, aiming to bootstrap promising business concepts and ideas and attract investors. The terms “accelerator” and “incubator” aren’t interchangeable, however — accelerators function in an eponymous sense, accelerating the growth of an existing company, while incubators are designed to build a functional business model from a promising concept or idea.

Accelerators are primarily concerned with scaling a business, while incubators lean heavily toward innovation. Your involvement with an incubator may last anywhere up to five years, while accelerators take an aggressive stance, typically operating over three to six month periods. Incubators are heavily weighted toward startup education, whereas accelerator programs focus more on intense mentorship and guidance.

In traditional markets these systems fulfill disparate needs. The rapidly changing technological landscape of blockchain innovation, however, has given rise to a hybrid approach that incorporates elements of both approaches. This hybrid model identifies promising ideas and nurtures them in a similar manner to incubators, but operates with a high-speed, mentorship-intense approach more in line with accelerator programs.

By providing innovative based startups with the educational resources, mentorship, and capital they need to succeed, the hybrid incubator/accelerator model is fostering the rapid development of successful startups in the competitive distributed ledger technology sector.

How Incubators and Accelerators Impact the Blockchain Ecosystem

Despite the highly profitable nature of the ICO market, even the most promising blockchain startups are required to contend with the same nascent business model and technology implementation issues faced by any other startup.

In many cases, a promising concept alone is not enough to guarantee success in the blockchain sector. Issuing tokens to investors via a crowdsale may generate startup capital, but many promising ICOs neglect token economics. Accelerators not only furnish startups with the expertise required to launch an operational business, but also assist promising platforms in determining whether their project is tokenizable at all.

As regulatory scrutiny of the initial coin offering market intensifies, blockchain incubators and accelerators are also assisting startups in navigating the complex ICO legal environment. The last year has seen a rapid succession of new blockchain focused incubators launch, often promising the opportunity to access decentralized capital.

Accelerator programs and incubators are designed to provide promising startups with the tools they need to succeed, but leave success in the hands of each individual company. Often, these programs require companies to give up between 6% and 10% of their equity in return for a range of services such as access to mentors, office space, regulatory advice, investor exposure, PR and marketing, or servers and cloud storage.

In many cases, however, most of these elements can be found through a modicum of hustling, networking, and extremely hard work. Often the promises made by accelerator programs and incubators can appear somewhat predatory, especially when these platforms present their solution as the gateway to success.

Accelerator programs may give promising blockchain startups with an environment that allows them to succeed, but the biggest advantage they offer is the promise of exposure to venture capital firms that are seeking to invest in them. In order to benefit from this exposure, a company must be in a stage of development at which it can actually benefit from investor and press meetings — which generally means a working product. Incubators provide a solution to this requirement, assisting startups in developing an MVP (minimum viable product) that greatly increases the chances of a successful funding round or launch.

Notable Incubators and Accelerators

There are a number of blockchain accelerators and incubators. Many of these blockchain focused springboards incorporate elements such as intensive accelerator programs, close mentorship, and startup capital opportunities, but each delivers a unique approach to blockchain project development. While these platforms are too numerous to list in a single article, we’ll proceed to highlight some of the standout accelerators and incubators active in the blockchain ecosystem.

Blockchain Space is a focused startup accelerator that is focused on assisting talented innovators in creating disruptive solutions to real-world problems with blockchain technology. The Blockchain Space platform offers promising projects an intensive 12-week multi-location accelerator program and presents participants with the opportunity to capture funding from Seedcoin, a UK-based blockchain incubator. The Blockchain Space accelerator is the brainchild of Eddy Travia, the CEO of Coinsilium — a blockchain-centric venture builder and accelerator platform that has worked with major blockchain platforms such as Coindash, Factom, and RSK.

The Bank of England FinTech Accelerator, Deutsche Bank Blockchain Business Solution Accelerator, and INV Fintech are accelerators focused on applying blockchain technology to financial use cases.

Collider X takes a different approach to blockchain project development, offering promising teams the opportunity to participate in a wholly open-source, crowdfunded and crowdsourced technical blockchain research and development platform. Collider X allows “tinkerers” to join the Collider X research network, submitting concepts and assisting with research. Investors interested in participating in the development of these concepts join as “backers”, and are able to pledge funds to promising projects, thereby supporting a unique model for collaborative open source research.

The Collider X platform can’t be considered a traditional incubator or accelerator, but instead functions as a distributed, decentralized intelligence hub. Recently, the World Economic Forum recognized the role Collider X is playing in the development of innovative blockchain technology in its “Realizing the Potential of Blockchain” whitepaper. Collider X takes an academic approach to the development of new blockchain concepts, and is partnered with a number of academic institutions around the world, including the Blockchain Hub at York University, the University of Toronto, and the University of Waterloo.

IBM’s Blockchain Accelerator is similar to the Collider X platform in that it operates with an academic approach to blockchain technology development, but is fee-based and offers access to IBM’s pre-built blockchain software assets. Adel, on the other hand, is more in line with the Collider X approach, offering a community-driven blockchain incubator environment that operates on a native cryptocurrency.

Huobi Labs presents pre-ICO blockchain projects with a traditional incubator model that provides funding in cryptocurrency, delivering hands-on advice, industry resources, mentorship, and insight. The Huobi Labs platform is an extension of Huobi’s Chinese cryptocurrency exchange, which currently sees daily trading volume in excess of $1 billion, and thus is placed in a strong position to invest in promising blockchain projects.

Notably, Huobi Labs has recently partnered with 500 Startups, a Silicon Valley-based startup accelerator. Together, Huobi Labs and 500 Startups are working with startups in the blockchain space, assisting with the development of white papers, business plan composition, marketing strategies, community engagement, and fundraising efforts. Huobi Labs has a strong track record in the development of blockchain platforms from a pre-ICO stage, assisting with the creation of IOST and CoinMeet.

Another Chinese company, JD.com, announced an accelerator focused on AI and blockchain, with Strategic Coin’s client CanYa being accepted into the program.

Wave Labs, Boost VC, Coin Apex, SparkLabs Group, and Outlier Ventures are examples of incubators that are similar in nature to the Huobi Labs platform, working with a traditional incubator model that offers startups the opportunity to kickstart their venture in return for an equity stake, either directly or via VC networking. Strategic Coin partner Bloq has Bloq Labs, which is incubating several open source projects and tokenized ecosystems.

Other so-called incubators are actually funds meant to support very specific ecosystems and technologies. For example, the Ethereum Foundation provides grants to innovative projects. Blockstack has an actual fund to invest in other startups that will become adopters of its own technology.

Finally, there are a group of ICO-generation companies that claim to provide incubation and funding for early stage ideas. TokenFunder, TokenHub, TokenKey, and Rocket ICO are examples.

Blockchain Incubators, Accelerators, and VC

While these blockchain accelerator and incubator platforms may assist promising projects in developing an operational business model and working product, they serve an important secondary purpose as a mechanism via which traditional VCs are able to access the potentially lucrative, rapidly developing blockchain space.

With governments around the world beginning to catch up to the fast-moving ICO industry through the development of agile regulatory frameworks, it’s possible that 2018 may bring the VC ecosystem a viable, legal method of investing directly into token offerings. For the time being, however, blockchain incubators and startups remain the most effective and reliable manner for institutional investors to partake in the blockchain innovation market at a pre-ICO level.

Questions for Future Research

- How can angel investors invest get involved with blockchain incubators?

- Will alternative crowdfunding efforts make incubators obsolete?

- What factors influence a decision to seek pre-ICO funding instead of joining an accelerator program?

Freelance writer Sam Town collaborated with Lawrence on this research.

Originally published on Strategic Coin, a website that is no longer operational.